Non-recourse litigation funding means the lender assumes the financial risk; if your personal injury case does not result in a settlement or favorable verdict, you are not required to repay it. Pre-settlement lawsuit funding is essentially a cash advance based on your expected settlement. You repay it only after your case is resolved and you receive your funds.

After a serious personal injury, pre-settlement funding can relieve immediate financial pressure and give you some breathing room to negotiate a higher settlement, so you don’t feel the urgency to settle quickly just to keep up with the bills.

How Non-Recourse Litigation Funding Works

Your attorney provides detailed information about your lawsuit and the expected settlement or jury award. Based on this, we decide whether to approve your pre-settlement funding application and the amount. If our assessment determines that liability is clear and your case is strong, we are more likely to approve it.

Remember, jury verdicts and insurance settlements are never guaranteed; that’s the risk we assume. If your case is not resolved favorably, it may be disappointing; however, you’ve had access to funds to cover your living expenses and won’t be responsible for repayment.

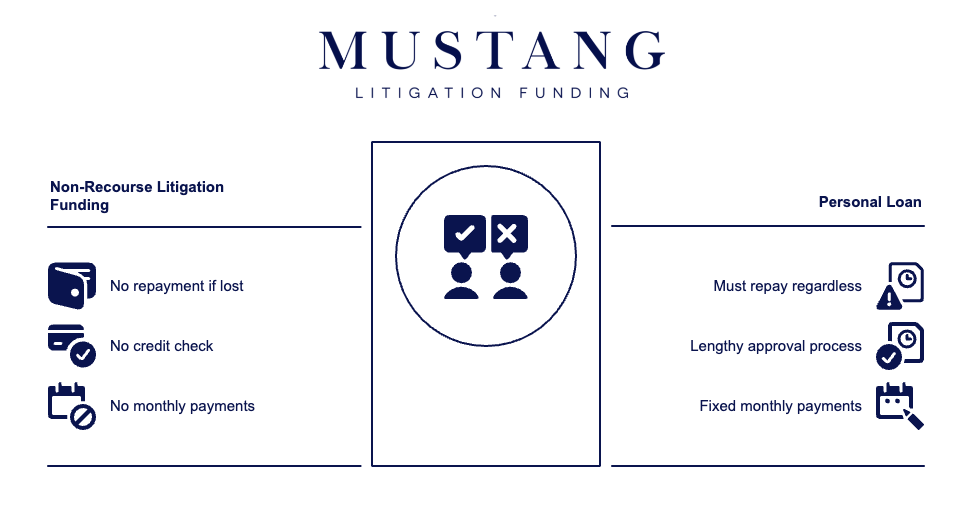

Non-Recourse Litigation Funding vs. Personal Loan

A personal loan is an option if you need funds to cover medical bills, rent, mortgage payments, or other essential expenses. However, it must be repaid regardless of the outcome of your lawsuit. Based on your creditworthiness, a personal loan also involves a lengthy approval process. You’ll need to submit extensive documentation, which may include proof of employment and detailed financial records.

Even after gathering all the necessary paperwork, approval can take days or even weeks. In contrast, pre-settlement funding is based on the merits of your case and the estimated settlement value, not your credit history or income.

Moreover, personal loans come with fixed monthly payments. With pre-settlement funding, there are no payments until your case settles.

How to Apply for Pre-settlement Funding

Plaintiffs with a pending lawsuit and legal counsel may apply for pre-settlement funding. If you are eligible, here is how pre-settlement funding works:

- Fill out our online application, including your attorney’s contact information.

- We contact your attorney to learn more about your case so we can prepare a proposal based on the likelihood of a good outcome.

- If approved, we will send you and your attorney documentation outlining the terms of your pre-settlement lawsuit advance. We encourage you to review this information carefully to ensure you’re fully aware of your rights and responsibilities when you accept pre-settlement funding.

- If your case qualifies and you agree to the pre-settlement funding terms, we will transfer your money in as little as one day from the time you sign your agreement.

At Mustang Litigation Funding, we believe transparency is essential for building trust and loyalty. Because we approve clients we believe have a strong chance of winning their claim, we don’t have to charge exorbitant rates and excessive fees.

Contact Mustang Funding Today

Mustang Litigation Funding provides best-in-class capital solutions for law firms, plaintiffs, litigation vendors, and other legal assets. If you want to learn more, see our Ultimate Guide to Pre-Settlement Funding. We have financed over 3,000 unique cases and dispersed over $170 million in funds across our portfolio. Have questions? Contact us today. We’d love to hear from you.

About Mustang Funding

Mustang Funding, founded in 2018 and based in Wayzata, MN, is a litigation finance company dedicated to empowering individuals and law firms nationwide with transparent and innovative financial solutions. With over $170 million funded, 10,000+ checks issued, and more than 3,000 cases financed, Mustang provides plaintiff pre-settlement funding, law firm financing, and commercial funding to meet diverse client needs. Their commitment to transparency, integrity, and expertise sets them apart, offering tailored financial support to plaintiffs, businesses, and legal professionals. By bridging capital gaps and fostering access to justice, Mustang Funding continues to lead the legal asset investment industry with a strategic, inclusive, and forward-thinking approach.

This post has been reviewed by a litigation funding expert from Mustang Litigation Funding

Mustang Litigation Funding