Home | Pre-Settlement Funding | How Pre-Settlement Funding Works

We consult your attorney and review your application.

If approved, we send you funds via wire transfer, as little as 24 hours.

Cover costs, gain peace of mind and concentrate on recovery.

Lawsuits take time. Sometimes, they take a long time as your bills pile up. The financial situation can feel impossible to manage, especially for those whose cases involve serious injuries and are suffering lost income on top of their medical bills.

In addition, plaintiffs who are desperate for financial stability give their opponents an unfair advantage at the negotiating table. Pre-settlement funding provides a solution to this common conundrum by offering upfront cash to litigants waiting to resolve their case.

At least with some cash in their pocket, plaintiffs are less likely to be pressured into accepting a lowball offer for their damages. Here, we provide a simple breakdown of how the process works.

But first, let’s start with the basic question:

Pre-settlement funding helps accident victims meet their financial needs while they wait for their claims to be resolved. Funding companies provide a financial advance directly to the claimant, not their lawyer’s office, to use in any manner they see fit.

So, pay your bills, keep food on the table, buy your Christmas presents – it’s nobody’s business what you need the money for. This is your economic lifeline.

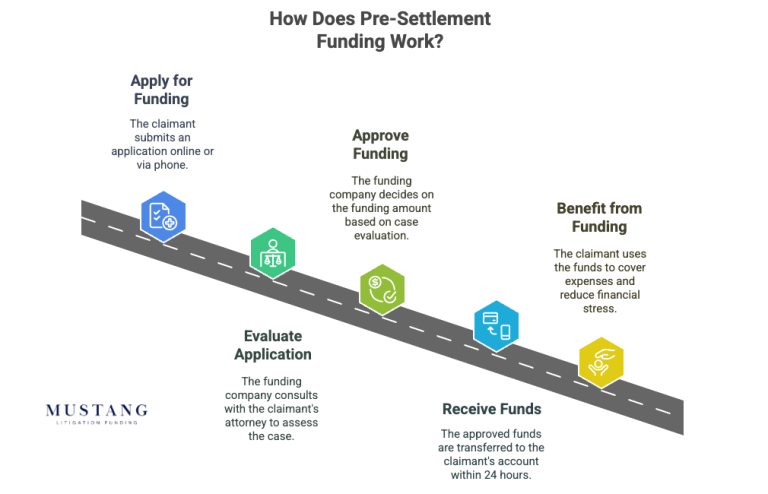

The Pre-settlement Funding Process

It is important to note that pre-settlement funding is only available to those who have retained an attorney and have a case already underway. The funding process is straightforward. Assuming you’ve met the threshold requirement of retaining legal counsel and have a pending legal action filed in court, the first step toward receiving a cash advance on your future settlement is to apply.

Every funding company and state has slightly different rules and application forms, but most will require your attorney’s input to help assess the value of your case. Always provide adequate contact information for the person or law firm handling your case.

At Mustang Funding, our internal team evaluates the strength of your claim and determines an appropriate monetary figure. After consulting with your attorney, we will base our final decision on whether we believe you will win compensation and how much you are likely to receive. If you have provided complete contact information for your attorney, we could have an answer for you in as little as 24 hours.

When you receive your proposal, review the details with your attorney. Your attorney is intimately familiar with the details and value of your case, so they are best equipped to provide counsel as to whether you should accept the funds and how much to accept.

If you accept the proposal, funds will be dispersed via check or direct transfer.

To obtain pre-settlement funding, you must have a pending personal injury lawsuit and representation by an attorney. Your lawyer plays a critical role in the funding evaluation process. The lender must consult the attorney to determine whether you have a strong case and are likely to obtain a substantial settlement or a favorable verdict if heading to trial. When evaluating an application, we ask applicants to provide their contact information and the name and contact information of their attorney.

Unlike traditional loans and other types of funding, we do not require personal financial information, such as credit profiles or bank statements, to determine eligibility. Instead, we focus on the strength of your lawsuit.

The actual application process for a pre-settlement loan can take less than two minutes.

The application is free, and there are no hidden fees or charges. One of our team members will promptly assist you after submitting it.

After consulting with your attorney, we will base our final decision on whether we believe you will win compensation and how much you are likely to receive. If you have provided complete contact information for your attorney, we could have an answer for you in just 24 hours. If approved, you should receive your pre-settlement funding within 24-48 hours. Funds are dispersed via check or direct transfer.

No, pre-settlement funding is not a loan. While we occasionally use the term “lawsuit loan”—since it’s a common search phrase—what we offer is technically different.

Pre-settlement funding is a non-recourse cash advance provided in exchange for a portion of your potential future settlement. Unlike a traditional loan, you are not required to repay the advance if you lose your case. In essence, we assume the risk. You receive funds upfront, and if your case is successful, we collect an agreed-upon share of your settlement.

Depending on the circumstances, pre-settlement funding is often a very good solution to your current financial situation. It provides temporary financial assistance, enabling your attorney to pursue optimal settlement terms.

Quick access to funds helps plaintiffs with pending lawsuits manage urgent financial challenges. A serious personal injury due to another party’s negligence often places you in a precarious state. While coping with the pain and limitations of your injury, you may be unable to work and support yourself or your family. On top of mounting medical bills, you might also struggle to pay rent or your mortgage and cover essential living expenses.

Your lawyer may be confident you have a strong case, but lawsuits can take months—or even years—to resolve. If your case goes to trial, the timeline could be even longer. In the meantime, pre-settlement funding can provide critical financial relief, helping plaintiffs avoid bankruptcy and stay afloat while waiting for their settlement.

If you have a fair credit score and do not mind a lender going through the income and employment verification process, a personal loan obtained from a bank, credit union, or online lender will likely cost you less in interest. Of course, this option requires that you repay the loan whether you win or lose your case. With pre-settlement funding, you do not have to pay it back since it’s non-recourse. We assume the risk.

Attorneys can often resolve financial claims prior to ever filing a lawsuit. Many cases are resolved in negotiations before ever filing suit. Even when civil cases are filed, approximately 95% of them are resolved prior to trial.

Remember, you are often dealing with insurance companies who might use every tactic, including making offers of settlement that fall far below any standard of fair compensation. Without a financial safety net, you could be pressured into making a bad deal.

Mustang Funding helps level the economic playing field so you can hold out until justice is served. We have streamlined the process with a simple, one-page application you can complete in just a few minutes. Submit your application now to get started. Got questions? Our team is eager to provide the answers you need.

Pre-settlement funding is generally not considered a traditional loan, although it is a form of financial advance. Pre-settlement funding is a non-recourse financial arrangement. This means that the funds are advanced to the plaintiff (the person filing the lawsuit) with the understanding that repayment is contingent upon a successful settlement or court verdict. If the lawsuit does not result in a financial award, the plaintiff is not required to repay the advanced funds.

We offer industry competitive rates for every 6 months your case is outstanding. Your exact rate, though, will depend on a number of factors related to the specifics of your case. If you’re approved for funding with us, we’ll send an agreement detailing the terms of funding.

In most jurisdictions, a lawyer does not have the authority to unilaterally deny you from seeking pre-settlement funding; the decision to obtain such funding is yours to make. It should be noted that we need the cooperation of your attorney in order to proceed with the funding application.

You can get additional pre-settlement funding as long as your case supports it. However, final approval may vary depending on a number of factors including case type and expected duration of case.

Customer service at its best, treated me with respect. Looking forward to being a happy customer!

Fast, quick, and easy, best way to go any day. Thank you for your rapid service.

Mustang Litigation Funding is 2ND TO NONE! We go nowhere else for our clients!

Mustang Litigation Funding works with capital partners and affiliated entities to provide a non-recourse cash advance to an individual. All non-recourse cash advances are subject to review and approval. Not all cases or requests will qualify. Certain states regulate non-recourse cash advances and may disqualify an applicant from receiving a non-recourse cash advance from Mustang Litigation Funding or its partners/affiliates.

This web site is for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or investment advice. You should consult your own tax, legal, investment advisors before engaging in any transaction.